Cyprus Real Estate: A Market Reignited

The Next Wave is Here

Last edit: July 2025

Mid-2025 marks a decisive upswing in Cyprus’s property market, with surging mortgage volumes, steady transaction growth, and mounting investor confidence across all major regions.

For investors and strategic partners, the signals are clear: the next cycle has begun—and it's accelerating.

A Reawakening in Credit and Confidence

In just the first half of 2025, Cypriot banks issued over €2 billion in new mortgages, a 31% increase year-on-year, while loan volume and average ticket size both rose sharply. Simultaneously, sale-document filings climbed 16%, creating a healthy pipeline of upcoming transactions. Behind the numbers lies a return of both institutional financing and private capital to the table—debt, equity, and liquidity are aligning.

Title transfers—the final legal step in ownership—also jumped 10% year-on-year, underscoring that these are not speculative movements, but real, capital-backed deals. In short: the market isn’t just heating up—it’s closing deals.

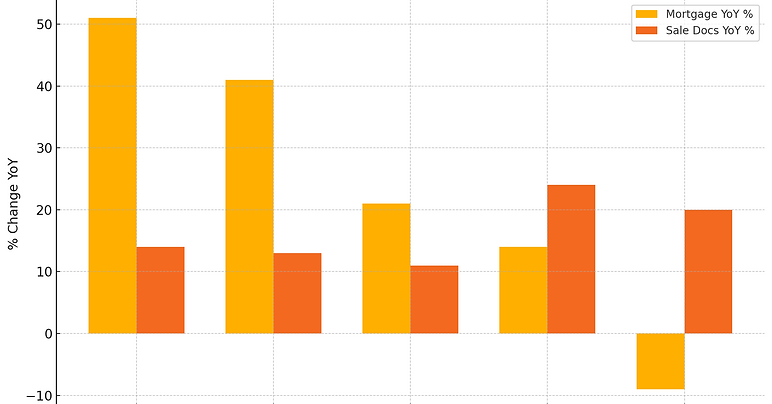

Cyprus Mortgage YOY Growth (2024-2025)

Source: The District Land Office, Cyprus

Nicosia leads the island’s property financing landscape with a remarkable 51% surge in new mortgage value, driven by a wave of office refurbishments, institutional rental conversions, and mid-rise residential developments. Limassol remains the undisputed high-value core, recording over €648 million in mortgage issuances during the first half of 2025, largely anchored by landmark projects along the marina and city waterfront. In contrast, Paphos exhibits sporadic yet impactful financing activity, indicative of large-scale hospitality and villa-cluster investments. Larnaca continues its steady ascent, with a 24% rise in sale filings suggesting strong demand in the port-redevelopment corridor—even as financing volumes lag slightly behind. Meanwhile, Famagusta tells a different story: mortgage activity remains modest, but transaction volumes are climbing rapidly, pointing to a cash-rich buyer segment focused on holiday homes and locally rooted trades.

Ask ChatGPT

Regional Dynamics

Limassol

-

Still the liquidity engine of the island: largest declared values every month.

-

March 2025: €152M declared — more than Larnaca + Famagusta + Paphos combined.

-

Strong investor appetite continues, especially from Russian, Israeli, and UAE clients, despite global interest rate pressure.

-

Risks: over-concentration in high-end, potential oversupply in Marina/Dubai-style towers.

Nicosia

-

Most consistent performer across sales, mortgages, and declared value.

-

In May & June 2025: €610M+ in property registrations.

-

Driven by:

-

Stable local demand (civil service, education, diplomatic community).

-

Tech & professional services growth (i.e., PwC, KPMG hubs).

-

-

Ideal for yield-seeking investors with mid-market appetite.

Paphos

-

Showed strongest late Q2 declared value surge (€105M in May).

-

Suggests large or luxury seasonal transactions (villas, second homes).

-

Still delivers solid net yields due to lower entry prices and high short-let demand.

-

Opportunity: Build-to-let projects near expat communities and British retirees.

Larnaca

-

Quiet out-performer: consistently gaining ground.

-

Lower average deal sizes, but increasing transaction volume.

-

Airport and port development projects are long-term demand drivers.

-

Good zone for small cap and logistics-backed investments.

Famagusta

-

Niche but awakening: doubled declared value in June (€20M).

-

Mostly seasonal and hospitality-linked trades.

What It Means for Investors

This momentum isn’t simply cyclical—it's strategic. Cyprus is seeing a shift from reactive purchases to forward-planned development, particularly in Nicosia and Larnaca. For AYA Urban Ventures and our network of global investors, the implications are clear:

-

LTVs (loan-to-value ratios) are rising, reaching nearly 89% nationally—indicating that banks are funding more ambitious projects with greater confidence.

-

Construction finance is flowing directly into end-user mortgages, creating seamless transitions and reducing holding risk for developers.

-

Cash transactions remain dominant in certain segments.

Strategic Insights

-

Mezzanine capital is under-served. With senior lending flowing freely, mid-layer equity in prime urban projects is a growing gap—and opportunity.

-

Larnaca is heating up early. High filing rates suggest presale entry points before pricing catches up. This is where early capital gains will be made.

-

Aggregator value in Paphos. Major projects are episodic and under-syndicated.

-

The June 2025 spike in transactions is the data-backed inflection point. It’s the perfect proof point for investor roadshows and EU capital campaigns this autumn.

Looking Ahead

With interest rates expected to ease and new legislation streamlining title registrations, the conditions are forming for a high-volume, high-velocity phase of real estate development. Yet with construction permits stagnant and input costs still elevated, supply—not demand—may be the limiting factor.

At AYA Urban, we’re already ahead of the curve—curating prime opportunities, structuring cross-border equity, and delivering institutional-quality deals to a selective network of global investors.

The next wave is here. Let's shape it together.

Interested in exploring strategic investments in Nicosia, Limassol, or Larnaca? Get in touch.